"While Meta makes it easy to drive conversions by uploading a massive list of 500,000 customers and letting them do the work, this approach ignores a critical flaw: you’re targeting customers with wildly different buying patterns."

Customer Lifetime Value (CLV) modeling quantifies the total value a customer brings to a business over their lifetime.

Unlike Meta’s conversion algorithms, which focus on short-term signals to maximize immediate results, CLV modeling provides a deeper understanding of customer behavior and long-term value.

By leveraging advanced techniques, CLV models identify high-value customers, predict their future actions, and guide smarter marketing strategies.

This approach not only fills the gaps left by Meta’s algorithms but also drives better ROI by targeting customers Meta often overlooks.

CLV modeling outperforms Meta’s conversion objectives, making it essential for modern marketing success.

Limitations of Meta's Conversion Algorithms

Meta’s conversion objective campaigns rely heavily on signals like pixel data and in-app behavior.

These campaigns prioritize high-intent audiences and charge a steep premium (often $40+ CPM) to target them.

There’s a reason most e-commerce businesses start with conversion campaigns: they show the strongest attributed revenue by leveraging Meta’s backend data and modeling to target buyers most likely to convert.

Meta identifies these audiences—essentially dynamic lookalikes—by analyzing purchasing patterns and identifying commonalities among high-value customers. They then use their vast data to find more people with similar characteristics, ensuring conversions but charging a hefty price for access to these optimized audiences.

The issue lies in Meta’s blind spots. While their algorithms are powerful, they:

- lack access to offline data

- can't fully align with unique business objectives

- rely solely on aggregated signals

When you integrate your own RFM data (Recency, Frequency, and Monetary value) and unique customer IDs, you gain a significant edge Meta can’t replicate.

This added signal allows you to predict buyers more accurately, optimize budget allocation, and even challenge Meta’s high-intent targeting.

Finally, focusing solely on conversion campaigns risks audience saturation.

Traffic and awareness campaigns might seem like wasted spend because Meta struggles to attribute their impact—but they’re critical for long-term growth.

Of course, proving the value of hard-to-attribute channels is where MMM (Media Mix Modeling) comes in. But that’s a topic for another day. Shameless MMM plug over. 😉

The question we asked ourselves is: Can we outperform Meta by adding our own signal to the mix?

What Makes CLV Modeling Different?

For our CLV modeling test, we only required three fields:

- Customer ID

- Customer Order Number

- Purchase Amount

From this data, we derived RFM (Recency, Frequency, Monetary) metrics, which gave us powerful insights into customer purchase behavior.

Using Bayesian modeling, we went a step further, predicting customer behavior—like when they’re likely to buy again.

Here’s the key difference: you have all this data; Meta doesn’t.

Meta’s algorithms rely on partial signals like pixel activity or in-app conversions, but they don’t have the full picture.

With CLV modeling, you can leverage everything you know about your customers—past purchases, frequency, and spending patterns—to predict and prioritize high-value customers.

This data complements Meta’s algorithms and often outperforms Meta by bridging the gaps they can’t fill.

A Real-World Comparison: CLV Modeling vs. Meta's Conversion Objective Campaigns

We ran a test within a Meta conversion objective campaign using manual conversion tracking, as we’re still cautious about Meta ASC’s performance based on our experience.

Typically, this type of test functions as a retention campaign: you shuffle your entire customer list, upload it to Meta, and let the platform leverage the signals it already has access to.

However, before diving in, it’s important to understand that larger databases generally perform better—but not all customers behave the same way—some may purchase only once a year, others may buy monthly, and others may shop quarterly or seasonally.

Graph showing the differences in consumer purchase frequency.

While Meta makes it easy to drive conversions by uploading a massive list of 500,000 customers and letting them do the work, this approach ignores a critical flaw: you’re targeting customers with wildly different buying patterns.

Imagine this scenario: You advertise to your entire customer list year-round, every day, hoping to generate sales. However, many of these customers might only make a purchase once a year.

If you’re serving ads to them daily for 364 days and only convert on day 365, your CPA will likely exceed profitability by 10x.

The point is simple: Timing matters.

Getting in front of customers at the right time is critical to maximizing ad spend efficiency and profitability.

That’s where probabilistic CLV modeling comes into play.

By using CLV models, we can predict who is likely to buy during a specific time frame.

For this test, we focused on a 5-week period.

We compared two segments:

- A master list (a large, unfiltered customer base typically used in retention campaigns).

- A curated list derived from our CLV model predictions, focusing only on customers most likely to buy during the selected 5-week window.

Our question was: What happens when Meta is given this extra signal? Does it perform better?

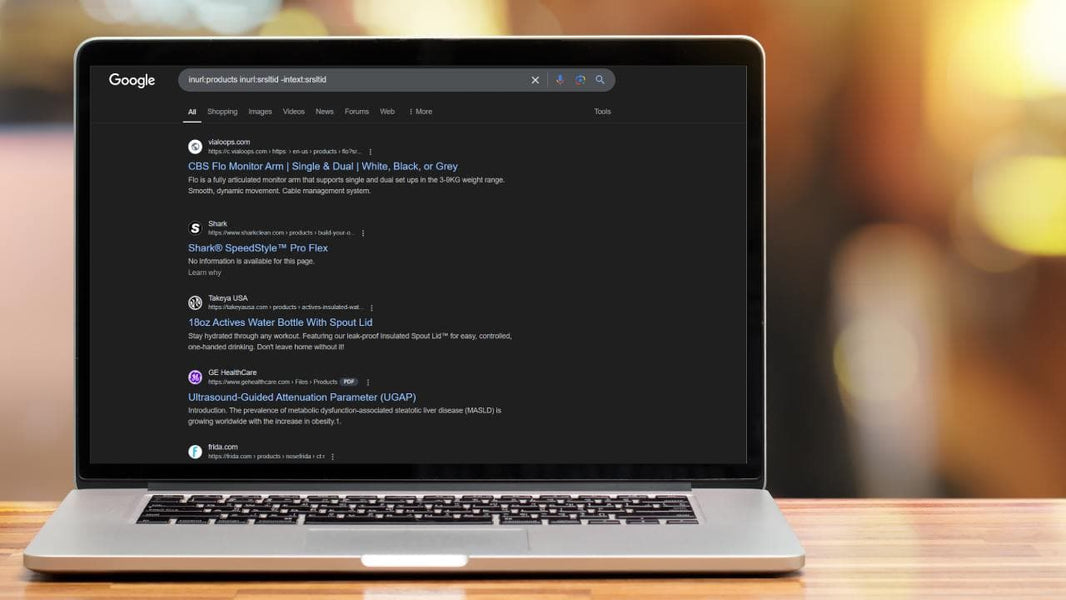

In the screenshot below, you can see the results of our test.

Two ad sets are shown, with the bottom one representing our custom CLV study.

Here’s the quick breakdown :

- Spend: $117,335 vs. $171,339

- GA Last-Click ROAS: 1.82 (CLV) vs. 1.34 (Master List)

- Platform ROAS: 12.72 (CLV) vs. 8.52 (Master List)

Comparison of Meta vs CLV Campaign Statistics

Now, let’s talk about the juicy stuff.

For this client, direct response marketing lives and dies by GA last-click ROAS, and we crushed it with a 1.82 vs 1.34.

But hold on—if you’re the skeptical type, you might have noticed a couple of eyebrow-raisers: higher CPC and lower AOV.

What’s going on here?

Well, let’s break it down:

- CPC: Meta loves a good ROAS, and when it sees high intent and strong performance (thanks to our modeling), it does what Meta does best—raises the CPC because it can. And you know what? We’re cool with it. The overall ROAS is strong, so we’ll take that slight CPC inflation any day.

- AOV: Ah, the dreaded dip in AOV. Why are these customers buying lower-priced items? Simple: frequency. When we look back at the RFM analysis, the data tells the story most companies overlook. On average, 80% of a company’s revenue from existing customers comes from just 10-20% of the customer base. These high-frequency buyers don’t always drop big dollars per order—they just buy more often.

And let’s not forget the seasonality factor.

This test ran during the holidays for a seasonal brand, so naturally, we saw more frequent purchases, a lower AOV, and ultimately, a higher ROAS.

All of this was exactly what we expected. Whoop whoop!

Now, let’s address the elephant in the room: Did we outsmart Meta?

No, we didn’t outsmart Meta—we just gave them more signal to work with.

Meta saw that extra push from our CLV modeling, took full advantage of it, and yes, raised the CPC.

But that’s okay because the results speak for themselves: lower CPP, better ROAS in GA and platform, and more purchases.

However, here’s the big takeaway: an always-on retention list, like the one in the first row, is a great baseline. But layering in segmented CLV-modeled lists for specific time periods (we’re fans of monthly) gives Meta the signals it needs to optimize even further.

It’s not about replacing what Meta does—it’s about enhancing it with your own data.

Let’s give Meta the assist and let them score the basket. As long as we’re winning, who cares? 😉

Key Takeaways

So what can we take away from this?

Let me say this: I really wish I could outsmart Meta, but let’s be real—I can’t.

Nobody is cracking Meta’s algorithms unless they’ve got the source code (and, well, good luck with that).

But what we can do is enhance what we already have and feed Meta smarter signals to work with.

Signal is the hot topic these days, and tools like Northbeam are doing something similar by using MTA-attributed revenue and feeding it back into Google via their Apex product (which I’m a big fan of, by the way).

It’s all about giving platforms better data to optimize with—not outsmarting them.

By predicting buying behavior with precision, we provide Meta with extra signal that enables better targeting and stronger results.

Here’s the playbook:

- Use CLV modeling to predict buying behavior and segment your audience based on intent and timing.

- Feed smarter signals into Meta’s already powerful system to help it optimize campaigns more effectively.

- Once you’ve nailed retention and understand your buyers’ behavior, use that knowledge to calculate customer lifetime value over, say, 12 months.

- With a better understanding of CLV, adjust your CAC (customer acquisition cost) targets and get more aggressive with acquisition strategies.

The big win here is alignment.

CLV modeling helps you leverage data Meta can’t access, aligns campaigns with your business goals, and maximizes every dollar you spend.

It’s not about outsmarting Meta—it’s about working smarter with Meta.

And trust me, the results speak for themselves.

Stay Ahead of the Competition

We hope you learned something from this post and, more importantly, that it inspires you to try new approaches. Testing and iterating are the only ways to stay ahead in the ever-evolving world of marketing.

If you’re looking to enhance your retention strategies with better returns—so you can reinvest that money into more aggressive acquisition efforts—we’d love to help.

Reach out to our team, and let’s explore how CLV modeling and smarter signals can drive your business forward.

Because at the end of the day, it’s not just about working harder—it’s about working smarter—and maybe outsmarting the competition while we’re at it. 😉